Three dimensional NAND (3D NAND) is expected to dominate the solid-state drive (SSD) industry beginning next year, as suppliers reduce their shipments of flash storage based on traditional 2D or planar NAND, according to a new report.

According to DRAMeXchange's latest forecast, NAND flash manufacturers are focusing their efforts on converting fabrication plants to 3D NAND, which is denser, faster and less expensive to produce than traditional 2D NAND.

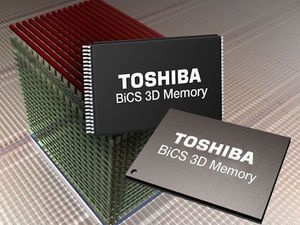

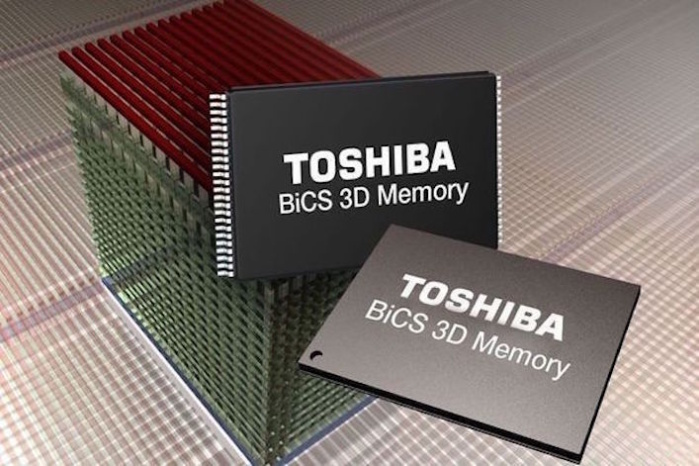

Toshiba

Toshiba Toshiba will begin manufacturing new 64-layer 3D NAND flash chips, which have 40% more potential capacity over the previous technology.

DRAMeXchange forecasts that the market supply of 2D NAND flash will begin to fall sharply in the first quarter. By the third quarter of 2017, the share of 2D NAND in the industry's total bit shipments will be under 50%.

"Since the second quarter of 2016, suppliers have sped up their respective 3D NAND development process," Sean Yang, research director of DRAMeXchange, said in a statement. "By the end of this year, 3D NAND is estimated to represent about 30% of the total flash bit shipments."

However, the NAND flash industry's wafer capacity is projected to increase by a marginal annual rate of 6% in 2017. That's because as the pace of the industry-wide transition to 3D NAND architecture accelerates, supply of 2D NAND memory will drop sharply, leading to shortages next year, Yang noted.

Because of the dearth of NAND flash wafers, DRAMeXchange expects prices to rise next year. At the same time, SSD demand worldwide is projected to soar by 60% in 2017 compared to 2016, DRAMeXchange stated, even as many flash memory suppliers are still getting mass production of 3D NAND memory up to speed. Many flash manufacturers are focusing on next-generation, 64-layer 3D NAND.

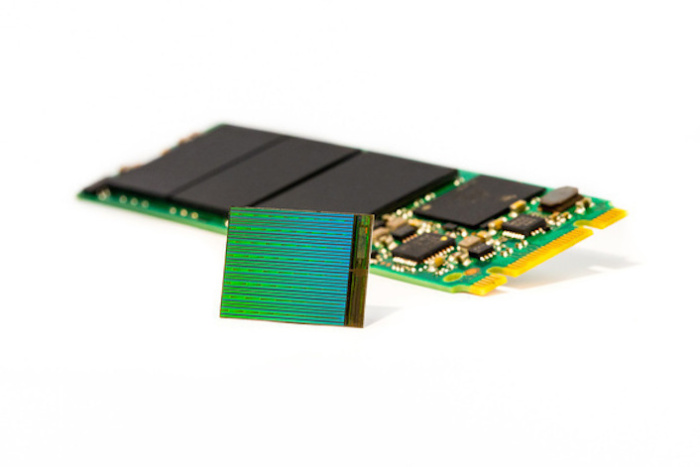

Micron

Micron An example of Micron's 3D NAND chip and gumstick SSD.

"Until the industry in general is able to apply 64-layer 3D NAND solutions to [SSD] storage products, the market supply for 3D NAND memory will remain tight," DRAMeXchange's report stated. "In the meantime, NAND flash prices will continue to go up and boost suppliers' revenues."

For example, Western Digital (WD) has begun manufacturing the third generation of its 3D NAND flash chips, which increases the number of layers from 48 to 64 and will allow it to double capacity.

Pilot production of the new 64-layer chips has already started in WD's Yokkaichi, Japan joint venture fabrication plant. Initial shipments are expected in the fourth quarter of this year with "meaningful commercial volumes" beginning in the first half of 2017.

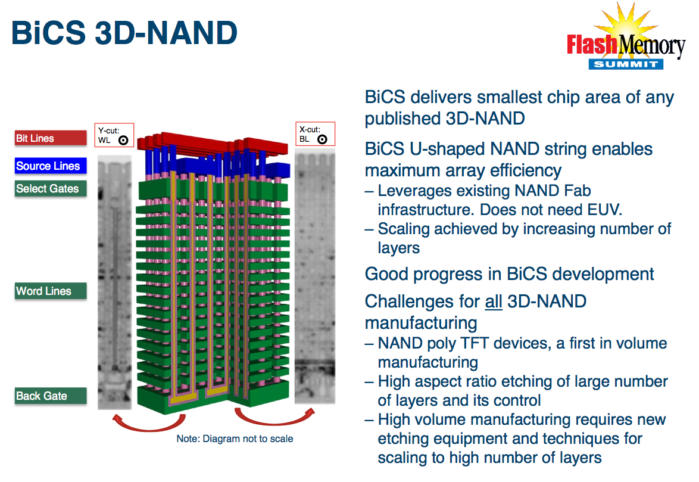

In 2015, SanDisk and technology partner Toshiba announced they were manufacturing the world's first 48-layer 3D NAND product using BiCS (Bit-Cost Scalable) technology. That BiCS NAND flash chip offered 256Gbit (32GB) of capacity and stored 3-bits-per-cell (transistor). The latest iteration of the technology is called BiCS3. According to Toshiba, the new 64-layer 3D NAND flash chips have 40% more potential capacity over the previous BiCS2 technology.

SanDisk

SanDisk SanDisk and Toshiba announced last year they are manufacturing 256Gbit (32GB), 3-bit-per-cell (X3) 48-layer, 3D NAND flash chips that offer twice the capacity of the next densest memory. They called their 3D NAND technology BiCS, short for Bit Cost Scaling.

Micron has also stated it will begin mass production of its 64-layer, 3D NAND flash chips by the end of this year.

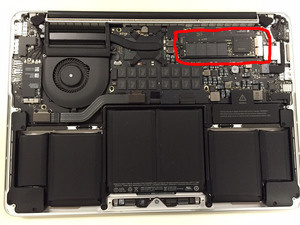

Overall, the SSD market will enjoy soaring demand next year and will represent 40% of all NAND flash consumption, DRAMeXchange's report stated.

"Thus, SSDs will represent the fastest growing end-use market for NAND Flash in 2017," DRAMeXchange said.

At the same time, smartphone shipments are slowing -- as are tablet shipments. So, the trend to increase memory capacity per device has become the main driver for mobile NAND flash products versus the sheer number of SSDs shipped.

Since 128GB, NAND flash SSDs account for the largest share of iPhone 7 shipments, other smartphone brands have also equipped their devices with lowerquality but high-capacity embedded MultiMediaCards (eMMCs), or next-generation Universal Flash Storage (UFS) memory in order to stay competitive.

Additionally, more than half of all notebooks shipped worldwide during the fourth quarter of 2017 will carry SSDs, according to DRAMeXchange. In the enterprise-grade SSD market, demand continues to rise due to strong growth in the data center and server markets.